The New Frontier

India’s AI market is entering a phase of financial accountability. Over the next decade, it is set to grow fivefold, from about ₹90,000 crore in 2025 to ₹4 lakh crore by 2031, a compound annual growth rate (CAGR) of nearly 30 percent.

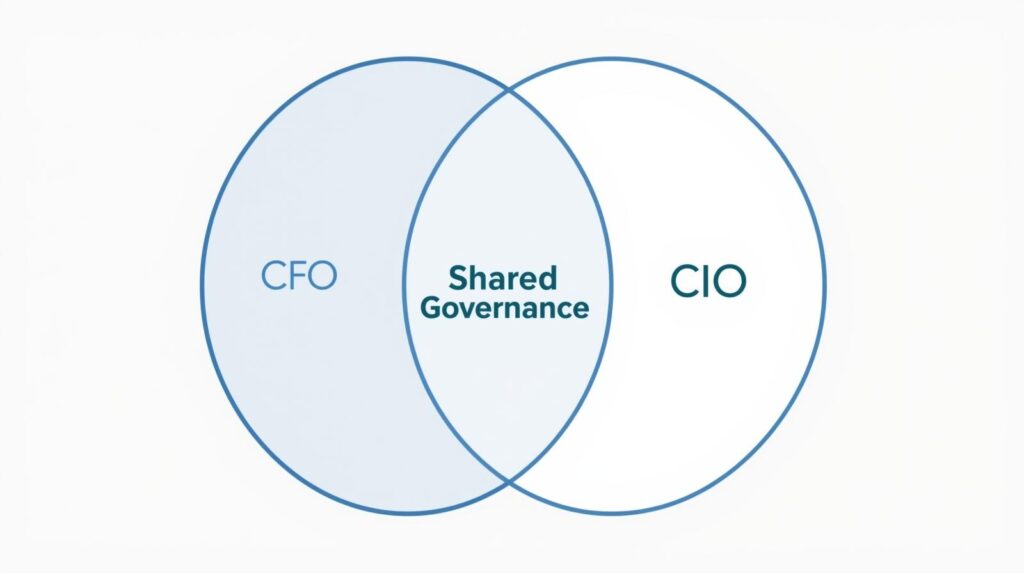

The direction of this growth is changing. AI’s future trajectory will be determined by coordinated leadership from finance and technology. CFOs and CIOs must co-author governance that links pilots to measurable financial returns.

According to Deloitte CFO Insights 2024, 82 percent of Indian CFOs are now directly responsible for digital and AI transformation. They are being asked to guide automation, data strategy, and performance measurement, areas once owned by IT.

This transition is visible across sectors.

For instance, in BFSI, the link between finance and AI has become explicit. Banks and insurers are deploying GenAI to shorten credit-assessment cycles, automate risk modelling, and increase forecast precision. CFOs are now tying these pilots to measurable outcomes such as liquidity planning and portfolio predictability.

AI projects are being evaluated for their contribution to cash-flow stability and working-capital efficiency.

Deloitte’s Asia-Pacific CFO Survey 2025 captures the expectation precisely:

“Boards, chief executives and other leaders are looking to their CFOs and finance teams to help chart a path toward sustainable value.”

The report goes on to mention how nearly 50% of the CFOs who responded to their survey expect generative artificial intelligence to substantially transform their industries, organizations, and finance functions within two years.

The statement and the findings signal a structural realignment.

For AI to deliver sustained value, its pilot phases must be integrated into the organisation’s financial governance, where its impact on margins, working capital, and growth can be measured and managed transparently.

The challenge ahead is measurement. For AI to be treated as an asset class within the enterprise, its outcomes must be traceable and auditable. As CFOs assume stewardship of this accountability, the conversation around AI now has to lean more toward financial return, risk, and governance.

The Execution Gap

Despite the impetus on CFOs to strengthen AI adoption in India, most mid-market organisations still struggle to progress beyond pilots. The shift from experimentation to scale frequently breaks down when financial and technical governance do not operate together.

Studies by ETCFO and EY–NASSCOM show that three structural weaknesses dominate these failures. These are fragmented data, weak coordination between finance and IT, and inconsistent systems. Each of these prevents pilots from moving beyond proof-of-concept.

The majority of initiatives still live within controlled test environments, producing localised success stories that rarely translate into organisation-level deployment.

Business World found that while 76 percent of Indian companies report positive ROI from AI experiments, very few can demonstrate that those results repeat across functions. The gap lies in the absence of a single system linking pilot data to business performance and budget accountability.

This cycle appears across industries.

In manufacturing, companies such as Tata Steel have achieved clear efficiency gains through AI in logistics routing and energy management. Yet these benefits remain uneven across plants because integration, budgeting, and cost-alignment principles differ by location.

Each site operates its own pilot conditions, leaving the enterprise without a unified financial view of performance.

CIO & Leader observed a similar trend:

“Despite growing boardroom pressure to demonstrate tangible business value from AI, many organisations remain stuck in the experimentation phase — unable to scale.”

This statement captures the national pattern. Indian firms are building AI pilots. They can, however, succeed when they solve a defined process problem.

Firms that broke through this pattern codified financial KPIs at the design stage and established regular CFO–CIO governance reviews. Those checkpoints converted technology validation into measurable capital logic, allowing them to scale within 12 to 18 months.

Others continued to treat AI projects as technical proofs, tracking accuracy and automation, but not cash impact. Their pilots multiplied, yet their ROI remained unverified.

The Governance Gap

The issue runs deeper than process or policy. It is structural, built into the IT Governance Framework that guides how most organisations manage pilots.

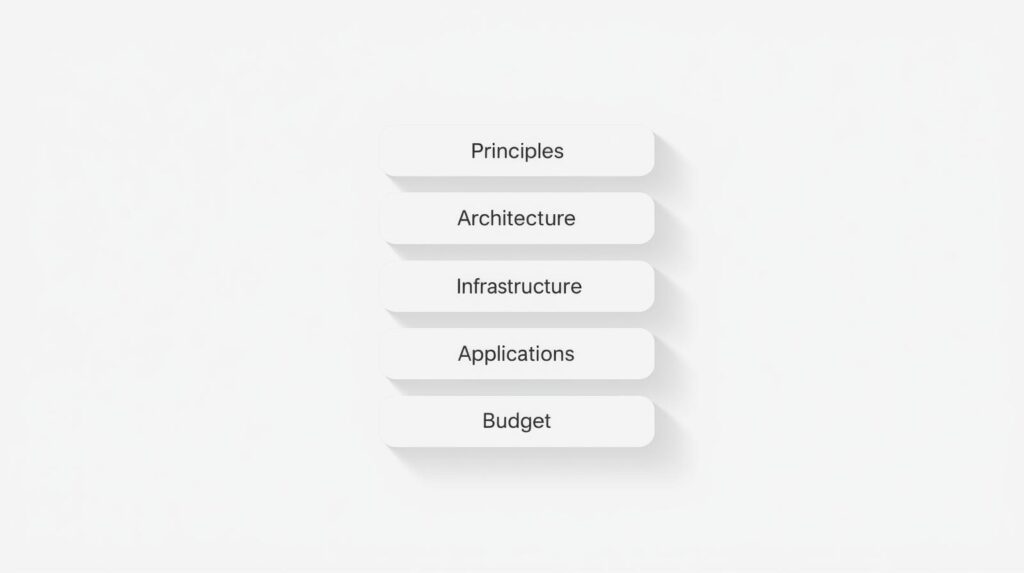

Traditionally, this framework has rested on five layers:

- Principles

- Architecture

- Infrastructure

- Business Applications

- Budget

These layers were designed at a time when IT functioned as a cost centre, not as a creator of value. The focus was on control, compliance, and depreciation alone.

As India’s AI adoption accelerates, this framework is beginning to show its limits. Governance frameworks created to track asset utilisation or software licensing cannot measure AI pilots’ contribution to profitability.

The metrics they offer, such as uptime, utilisation, and delivery timelines, reflect operational control but say little about capital efficiency, ROI, or productivity gains.

Evidence from industry analysts confirms the gap. EY–NASSCOM data shows that 44 percent of Indian organisations still work with inadequate or siloed data, enough to block enterprise-level AI scaling.

As an example, In the consumer goods sector, the Infosys Knowledge Institute found that while 55 percent of AI use-cases deliver tangible business value, companies face “high transformation requirements.” This shows that the underlying data and governance infrastructure is fragmented.

The missing layer across pilots is financial logic, a mechanism that translates technical outcomes into measurable return.

Cognizant, in its CFO Guide to AI Investment, captures this relationship succinctly:

“Productivity gains must help create higher-value work; the real ROI emerges when technology investments are matched by human elements.”

This statement reframes the purpose of AI governance. Technology must elevate work, optimise capital, and increase measurable enterprise value.

For the Indian mid-market, this is the next transformation frontier. AI pilots need rules built for profitability and value expansion.

When Frameworks Fall Behind

Indian firms have made rapid progress in building AI capability, but most pilots still fail to convert into repeatable business outcomes. The underlying problem is that projects often begin with technical objectives and budgetary approval, but without defined financial accountability or shared ownership between the CFO and CIO.

Early successes remain isolated, and companies struggle to establish the structures needed to evaluate performance, reinvest, and scale responsibly.

An RMPSCO survey confirms that large Indian enterprises still lag global peers in end-to-end AI adoption. The weakness lies in how AI connects across departments, functions, and financial systems.

In healthcare, the EY–CII HealthTech Survey 2025 illustrates this perfectly. It found that 50 percent of hospitals identify data integration and BI-tool adoption as their single largest barrier in their digital journey, even though innovation budgets are set to grow by 20 to 25 percent.

It shows that organisations are spending more on technology without redesigning the governance mechanisms that make those investments accountable.

At a Finance Leadership Dialogue hosted by Financial Express and Oracle, one CFO summarised the risk in plain terms:

“Many AI systems are under-utilised, which might result in unsatisfactory returns on investment.”

That statement captures the pattern across industries. As AI budgets expand, utilisation gaps widen because the frameworks governing these investments were never intended to manage adaptive, probabilistic systems.

Traditional governance ensures compliance and delivery, but it cannot guarantee alignment between technical progress and financial performance.

For India’s next wave of AI growth, firms must modernise governance at the same pace as they modernise technology.

Redefining IT Governance for the AI Era

India already has the frameworks. The next step is to link them to financial accountability, so that AI adoption is managed by its contribution to organisational performance.

The NITI Aayog National Strategy for Artificial Intelligence (#AIForAll) laid the foundation in principle: ethical standards, infrastructure guidelines, and leadership priorities for responsible AI adoption.

The next phase is about converting national and organisational frameworks into measurable financial routines that can guide AI pilot projects. This is where the CFO and CIOs become co-authors of digital governance.

Across industries, examples of this shift are emerging. In manufacturing, for instance, AI deployments at Siemens and Tata Steel are reporting efficiency improvements of up to 45 percent, contributing to what global studies estimate as a ₹4400 lakh crores of potential value pool by 2030.

These numbers are the outcome of structured collaboration between technical and financial leadership.

As Infosys BPM observes:

“Cross-functional collaboration is critical for identifying and maximising GenAI applications across the enterprise. CFOs should engage across departments to explore how AI in finance can drive value beyond traditional functionalities.”

That insight shows that the finance function becomes the control tower that ensures AI initiatives align with organisational priorities, supported by the same level of measurement and auditability that applies to any capital expenditure.

To make that alignment real, CFOs can follow a clear playbook.

Playbook for CFOs: Redefining IT Governance

- Revisit IT Principles — Embed financial accountability at the pilot’s approval stage. Every AI initiative should state its expected impact on margins, working capital, or capital efficiency.

- Co-define Architecture with the CIO — Technical architecture must guarantee data traceability for ROI calculation.

- Reinforce Infrastructure Standards — Align infrastructure decisions with long-term cost visibility. Cloud, compute, and storage choices should be evaluated for their effect on the total cost of ownership and return on digital assets.

- Re-evaluate Business Applications — Review AI-enabled applications for measurable process and capital impact. Each app should contribute to either productivity gains, faster cash cycles, or lower operating costs.

- Align Budget Cadence with Pilot-to-Scale Metrics — Replace annual funding cycles with continuous performance-linked budgeting.

When executed together, these shifts create a governance framework that links every pilot to an outcome.

For India’s mid-market, this is financial reform. AI’s future scale will depend on how precisely finance can govern the data gathered from pilots.

Translating this reform into practice requires a system that allows CFOs and CIOs to apply these principles in real time across projects and budgets.

Operationalising the Framework

Budgets are expanding faster than policies.

Across sectors, AI investment is accelerating without equivalent advances in governance. This Economic Times article states that accelerated AI adoption could add up to ₹53 lakh crore to India’s GDP by 2035.

The potential is enormous.

This is where Excellenc3 acts as the system enabler. It bridges the structural gap between what companies are spending on AI and what they can measure.

In industries such as logistics, the results of automation are already tangible. Studies such as IJRRR 2025 show 35 percent cost savings in labour and fuel and 40–60 percent throughput gains through AI-driven routing, scheduling, and demand prediction. Yet sustaining those gains depends on shared oversight between finance and IT.

As Cognizant notes:

“Unlike traditional IT projects, AI outcomes can be probabilistic and evolve over time. Establishing cross-functional accountability between finance, operations and data science is essential to monitor performance metrics.”

This is precisely the challenge Excellenc3 resolves. The platform turns the concept of IT governance from a set of policies into a management framework, ensuring that both technical and financial stakeholders work from a unified view of performance.

How Excellenc3 operationalises governance

Excellenc3 follows the five-layer logic of IT Governance, but re-engineers each layer to include financial traceability.

- Principles — Co-authored by finance and IT, these define measurable intent from the start of every AI pilot. Each project begins with quantified targets for ROI, productivity, or working-capital efficiency.

- Architecture — Excellenc3’s solution integrates data from diverse systems into a unified model, ensuring traceability across every data lineage. This allows both CFOs and CIOs to see how technical workflows and decision points connect directly to operational and financial KPIs.

- Infrastructure — The platform provides visibility into the underlying compute and storage environment, linking resource consumption to total cost of ownership and performance outcomes.

- Business Applications — Each AI-enabled application is reviewed jointly for technical robustness and financial value. This improves measurable business outcomes like margin expansion or cost-to-serve reduction.

- Budget — Live dashboards track spend, ROI, and working-capital effects in real time for each pilot. CFOs and CIOs gain a shared view of how every AI initiative performs against budget, expected return, and operational throughput.

Through this model, a CFO can see where capital is allocated, how data is used, and what outcomes it is generating. Within the same governance environment, the CIO and data science teams can quantify the technology’s performance.

Building Financial Visibility for AI

Excellenc3’s solution enables CFOs and CIOs to operationalise the financial responsibility of each pilot through a single governed environment. It re-architects the traditional IT Governance Framework to embed financial logic into every decision point through these characteristics.

1. Centralised Governance and Pilot Data

The solution serves as the organisation’s single repository for AI governance. Pilot designs, approval principles, ROI projections, financial KPIs, and technical metrics are stored in one controlled environment.

2. Linked Financial and Technical Tracking

Within the solution, modules for financial management and technical performance interact dynamically. A CFO can view how pilot-level indicators, such as cycle-time reduction, model accuracy, or data-quality index, translate into changes in ROI, working-capital efficiency, or forecast precision.

3. Redefined IT Governance Principles

The platform introduces configurable governance templates that embed financial oversight directly into IT Principles. CFOs participate in drafting these principles and in reviewing every AI Business Application against quantifiable outcomes.

4. Standardised Collaboration and Governance Workflows

Built-in workspaces allow finance and IT leaders to define principles jointly, assign responsibilities, and manage governance policies through role-based access and automated notifications. Deviations trigger alerts that close the loop between financial control and technical operations.

5. Measurable Visibility and Decision Support

Interactive dashboards consolidate performance, budget variance, and outcome metrics in real time. CFOs gain a forward-looking view of which pilots are generating tangible returns. Automated summaries display metrics relevant for board reporting, such as ROI achieved, working capital released, and benefit-to-cost ratio.

The outcome is that every pilot becomes a traceable investment in productivity, working-capital efficiency, and capital returns.

Excellenc3 turns what was once an outdated governance framework into a functioning system of accountability.

Proof of Control

Governed pilots perform better. The evidence supporting that claim continues to build across sectors.

An IBM study found that 89 percent of companies launched more than ten AI pilots in 2024, yet most of them named weak governance as the leading barrier to scaling.

The insight proves that pilots often get implemented in isolation and may deliver functional results, but cannot replicate those results across geographies or divisions.

In manufacturing, the same pattern repeats. Small and mid-sized enterprises report 20–30 percent uptime improvements when they apply AI to critical assets such as assembly robots, but only after governance and metrics are formalised.

Governance turns one-time efficiency into repeatable gain.

As CIO & Leader summarises:

“For Indian CIOs, the challenge is not experimenting with AI; it’s scaling it across legacy-laden environments and ensuring it remains aligned with business goals.”

Governance provides that alignment — the missing variable between pilot and payoff.

When it functions properly, CFOs and CIOs gain continuous visibility into both technical progress and financial outcomes. They can intervene early, reallocate budgets, and standardise processes without waiting for quarterly results.

Over time, this structure ensures fewer redundant pilots, faster learning cycles, and a clearer view of ROI across the product portfolio.

Embedding Financial Logic

AI projects that remain technical in isolation tend to plateau, while those anchored in financial logic succeed predictably.

Cognizant recommends that CFOs model both visible and hidden costs of AI deployment before any sign-off. Visible costs include licenses, infrastructure, and integration. Hidden costs include training data curation, post-deployment monitoring, and model recalibration. Without a structured view of both, the financial picture remains incomplete.

The MSNIM Management Review 2024 highlights this underlying issue, finding that many manufacturing firms struggle to justify early AI investments precisely because ROI tracking is inconsistent.

The absence of traceability of all kinds of costs leaves CFOs uncertain about how to assess payback or capital efficiency. In turn, this makes it difficult to defend scale-up budgets before the board.

To correct this, CFOs need to embed financial logic at the pilot’s inception.

When AI pilots carry financial KPIs from inception, the following occurs:

- CFOs gain a live view of value creation rather than a retrospective ROI report.

- Data lineage mapped to the P&L reveals where efficiency translates into capital benefit.

- Application reviews evolve from technical gatekeeping to business validation, ensuring that only initiatives with measurable outcomes proceed to scale.

- Real-time budgeting links financial performance to deployment velocity, allowing resources to flow toward high-impact pilots.

- Regular joint reviews between finance and IT sustain this alignment, making governance a working process.

As Cognizant adds:

“AI should be deployed where it augments human decision-making or automates repetitive tasks with measurable impact.”

When CFOs and CIOs treat algorithms like capital investments, AI transitions from being a technical experiment to a managed asset class with accountable performance.

As more organisations adopt this governed approach, these practices will shape the wider ecosystem, creating a foundation for scale across India’s AI landscape.

Financial Logic at Scale

India’s AI ecosystem is positioned for scale but continues to stall at the pilot stage. Achieving organisational-level adoption will require stronger alignment between technical capability and financial governance.

About 67 percent of Indian AI startups now focus on enterprise applications, signalling that both demand and capability are gearing up for wider adoption.

This shift represents that organisations are beginning to treat AI as an operational layer of business governance.

In manufacturing, the transformation is already quantifiable. Godrej & Boyce’s Factory360 AI programme is projected to deliver ₹221 crore in bottom-line savings over three years. This figure is evidence of a governance structure that aligns technology investments with measurable capital return.

When CFOs engage early, AI pilots evolve differently. Financial participation at inception defines what success means, how it will be measured, and when it becomes reportable.

The IMD Business School articulates the same underlying philosophy clearly:

“If CFOs focus on funding initiatives aimed at solving tangible problems, they will indirectly contribute to the generation of knowledge and the cultural evolution needed to use AI for more complex challenges.”

This statement shows that CFOs are enabling cultural alignment in AI adoption. When finance funds real-world solutions rather than experiments in isolation, it reinforces a mindset of problem-solving and disciplined learning.

The new governance model moves IT from cost-centre to value-centre, converting every pilot into a measurable contributor to productivity, working-capital efficiency, and capital returns.

As measurable results continue to surface across sectors, from BFSI and healthcare to logistics and retail, boards will be pressing CFOs to translate these outcomes into company-wide adoption.

The next phase, therefore, is expansion grounded in financial logic, governed by shared accountability, and validated through performance data.

For India’s AI economy, this phase represents the shift from fragmented AI innovation to accountable, results-driven deployment.

From Experiment to Enterprise

Across the Asia-Pacific, the expectations around AI are accelerating, and so is investment. Roughly half of CFOs now believe that AI will transform their industries within the next two years.

The evidence of this shift is already visible.

In healthcare, Apollo Hospitals provides one of the most instructive examples. The organisation has deployed AI across diagnostics and report scanning, achieving tangible improvements in speed and consistency of results.

On the strength of those outcomes, it now plans to double its investment in AI capabilities, signalling both confidence and a clear governance approach.

This approach shows that as AI investments mature, CFOs are looking for proof of the impact of AI pilots.

As analyst Joanna Miler notes:

“AI has turned the CFO from a traditional controller of numbers into an architect of business value and growth.”

The quote proves that the CFO’s role is expanding beyond financial stewardship to designing the logic of transformation, along with the CIO.

The message is clear. Firms that build governance around AI experiments will create durable, repeatable value that strengthens both financial performance and organisational capability.

This transition calls for shared accountability between finance and technology, continuous measurement instead of milestone tracking, and frameworks that ensure every initiative is accountable to outcome.

The Excellenc3 Advantage

Organisations piloting AI projects need a system of financial governance for AI that ensures every investment delivers measurable, traceable value.

Excellenc3 plays that role. It brings together pilot data, financial metrics, and technical performance into a single, governed environment, so that CFOs and CIOs can co-own every decision.

It ensures:

- Every pilot has financial KPIs at inception.

- Every dashboard links spending to ROI and working capital.

- Every scale-up meets both technical and fiscal thresholds.

For CFOs redefining the future of AI adoption at scale, Excellenc3 provides the architecture of accountability. It provides the financial logic, data traceability, and control mechanisms required to move from pilot to large-scale deployment.

In an environment where AI budgets are rising faster than governance frameworks can adapt, Excellenc3 becomes the stabilising force that empowers CFOs and CIOs to measure what matters.

Explore how Excellenc3 gives CFOs the tools to link every AI initiative to return, efficiency, and accountability.